No Deposit And Low Deposit

What Is a No-Deposit Home Loan?

A no-deposit home loan is one where you are approved for 100% of the property value, meaning you don’t have to pay a deposit. With most lenders, you will require a deposit of at least 5% for most loans; however, there are ways to avoid paying a deposit.

These options are available to you when you don’t have a deposit.

- No deposit with a Guarantor

- No deposit using equity in another property.

Family Guarantee Loans

Saving the deposit for your first home can be difficult and take a number of years. One way to potentially get into your own home sooner is by having a family member act as a guarantor.

Many lenders allow parents or someone who is close to you, to use the equity in their property as security for your home in lieu of you saving the full deposit required. This person is known as a guarantor.

How Does It Work?

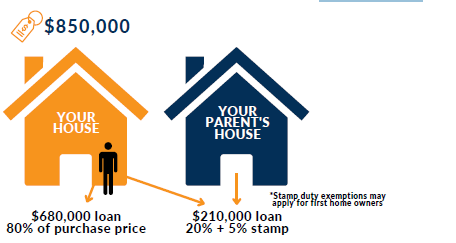

With a family pledge guarantee, your mum and dad can provide their home as security to the loan, so you don’t need to save the full deposit required by the lender.

The Easiest Way To Explain This Is To Give You An Example.

If you were looking to buy a house valued at $850,000, you would need to save a minimum 5% deposit or $42.500. To avoid paying mortgage insurance you need a deposit of at least 20% of the purchase price of $850,000 ($170,000). That’s another $127,500 you would need to save!

Now, your mum and dad have a home valued at $1,200,000 and are willing to help you out. They offer you the $120,000, but not as cash, as security for the loan. This means the lender will take the offered security of $120,000 in your parents’ home so you don’t have to pay the mortgage insurance premium and don’t have to save that extra money!

Once the equity in your home reaches 20%, you and your parents can apply to the lender to release the guarantee.

The guarantor’s security (i.e. mum and dad’s home) does not cover the entire loan amount. Just a portion of it in lieu of you having to save the full deposit. The guarantee is limited to this amount.

How Is It Different To Being a Co-Borrower?

A co-borrower on the loan is someone who is responsible for the entire loan until the debt is repaid in full as compared to a guarantor who is linked to the loan by a guarantee and is responsible for the amount specified in the guarantee.

A Guarantor is linked to the loan by a guarantee. This guarantee can be released and the guarantor’s responsibility will cease without the loan being repaid in full.

Who Can Be a Guarantor?

Guarantors are generally limited to immediate family members. Normally, this would be a parent, but it can include siblings and grandparents. There are obviously conditions around this, for example your parents or the person acting as guarantor must have the equity available in their property and an income. If we use the above example, if your parents’ home was valued at $1,200,000 but they had a mortgage of $1,000,000 then the equity is not there to offer this to you.

Benefits For First Home Buyers

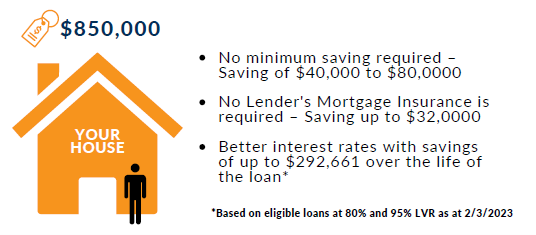

The main benefit of having a family pledge guarantee is that it may be able to help you avoid Lenders Mortgage Insurance (LMI), or considerably reduce the premium that you would otherwise need to pay. This is typically a one-off fee paid by the borrower to the lender to protect the lender against financial loss should you be unable to meet your mortgage repayments. Lenders typically require borrowers to pay LMI on loans where the borrower has a deposit of less than 20% of the property’s value.

For more information on LMI refer to our LMI fact sheet or speak to your mortgage broker.

It is important to remember that as the borrower, you will be responsible for your loan repayments and you’ll need to be able to service the entire loan with your income. You should always speak with your broker about ensuring you are comfortable that you can afford the loan repayments that will be required.

Other possible benefits of a guarantor home loan include:

- You may not have to save as much for a deposit

- You could get into the property market faster and more easily

- You can get the home you have fallen in love with and not have to settle for a cheaper alternative

While there are clearly some benefits to going guarantor, given it’s such a large financial commitment, it’s also worth weighing up the potential risks.

Considerations For Guarantors

While it may sound like a great option to getting you in to your first home quicker, there are always risks that you and the guarantor need to be comfortable with.

The main consideration for the guarantor is ultimately, they will be liable to cover the mortgage repayment and fees if you are unable to. It pays to consider how they would cope financially if the unexpected happens and have to make those repayments. Specifically, parents on the path to retirement could be financially compromised and at worst, they could risk losing their own home if you were unable to make the repayment.

Taking on the role of a guarantor is not something that should be taken lightly. Anyone considering being a guarantor for a property loan is advised to seek independent legal and financial advice before accepting the role. In fact, most lenders will insist on this, prior to accepting a guarantee.

Understand Your Obligations.

The last thing you want is to cause any family tensions, so fully consider whether this is the right option for you and the person you are asking to be guarantor. It’s very important that both you and your guarantor understand all of the conditions and obligations of a family guarantee before signing. For this reason it is essential thatguarantors seek legal advice before entering into any guarantee agreement.

More Information

Normal lending criteria and bank policy applies to guarantor loans, so you should discuss your borrowing eligibility with your mortgage broker. It’s important to remember this is only a guide to help you ask the right questions and highlight the important considerations.

Want to talk about your options?

Get in touch with the Sanford Finance team today on info@sanfordfinance.com.au or (02) 9095 6888

Home Equity Loans

A home equity loan allows you to borrow against the equity you’ve built up in your home.

Equity is the difference between the market value of your home and the outstanding balance on your mortgage.

Here’s how it works and how you can use it to buy a new home:

Using a Home Equity Loan To Buy a New Home

- Access to Funds: A home equity loan provides you with a lump sum of money that you can use as a down payment on a new home. This can be particularly useful if you’re looking to purchase an investment property or a second home.

- Bridge Financing: If you’re buying a new home before selling your current one, a home equity loan can act as bridge financing. This allows you to make a down payment on the new home while you wait for your current home to sell. For more on Bridging loans

- Avoid LMI: Using a home equity loan can help you avoid paying Lenders mortgage insurance (LMI) on your new home loan if the combined loan-to-value ratio remains within acceptable limits.

- Lower Interest Rates: Home equity loans often come with lower interest rates compared to other types of loans because they reduce the Loan to value rations and are therefore less risky for the lender.

- Tax Benefits: In some cases, the interest paid on a home equity loan may be tax-deductible, although this depends on current tax laws and your specific circumstances.

What Else Can I Use a Home Equity Loan For

Want Other common uses other than buying a home, Equity can also be used toward:

- Renovate your home.

- Debt Consolidation including Credit cards, Personal loans and Tax Debt

- Invest in stocks, shares or Managed Funds

- Buy or Invest in your Business.

- New Car or Boat

- Pay for a holiday, Wedding, Medical expenses.

In short, you can use a home equity loan for any purpose, all at home loan interest rates, which are often more affordable than other forms of credit.

Want to talk about your options?

Get in touch with the Sanford Finance team today on info@sanfordfinance.com.au or (02) 9095 6888

Low Deposit Home Loan Options

If you don’t qualify for a no-deposit home loan and you have savings, you may be eligible for a Low-Deposit home loans.

These options include:

- 5% deposit with First Home Guarantee Scheme

- 5% Deposit with a Gift or Inheritance deposit 2% Shared Equity Home Buyer Scheme Limited Time

First Home Guarantee Scheme

The First Home Owner Scheme (FHBG) is designed to help buyers enter the property market with a smaller deposit.

This scheme allows eligible buyers to secure a mortgage with a deposit as low as 5%, with the government providing additional support to make up the difference. The FHOG can be used towards the purchase price, reducing the overall loan amount required and making homeownership more accessible for first-time buyers.

Eligibility Criteria:

To apply for the FHBG, home buyers must be:

- Applying as an individual or two joint applicants

- An Australian citizen(s) or permanent resident(s)* at the time they enter the loan at least 18 years of age

- Earning up to $125,000 for individuals or $200,000 for joint applicants, as shown on your latest Notice of Assessment (issued by the Australian Taxation Office)

- Intending to be owner-occupiers of the purchased property

- First home buyers or previous homeowners who haven’t owned or had an interest in a real property in Australia (this includes owning land only) in the past ten years.

The number of places in the FHBG is capped each year and limited to select lenders

If scheme places have been exhausted, but you’re eligible, you can still submit a reservation request, and you’ll be added to the waitlist.

When and if a Scheme place becomes available, you will be advised.

Want to talk about your options?

Get in touch with the Sanford Finance team today on info@sanfordfinance.com.au or (02) 9095 6888

Gifted Deposit Home Loan

A gifted deposit, as the name suggests is a lump sum gift with which you don’t have to repay. As a rule of thumb, parents or close relatives are eligible to give you a gifted deposit. If the gift is coming from a distant relative or your extended family, in most cases the mortgage lender will seek to understand your relationship before granting mortgage approval.

- Gift can be for 5% to 20% of the purchase price as a non-refundable gift.

- The lender will require a Letter or Stat Dec confirming the gift amount.

- Funds are not required to be transferred until settlement is ready.

Shared Equity Schemes

Dreamed of owning your own home but just don’t have the means to do it on your own? A recent scheme from the NSW Government could help to make those dreams a reality.

- NSW: Shared Equity Home Buyer Helper

- Victoria: Victorian Homebuyer Fund

- Queensland: Pathways Shared Equity Loan

- ACT: Shared Equity Scheme

- South Australia: HomeStart Finance Shared Equity Option

- Western Australia: Shared Home Ownership

- Tasmania: MyHome Shared Equity Scheme

- Northern Territory: Not available

NSW Shared Equity Home Buyer Helper

What is the Shared Equity Home Buyer Helper?

The NSW Government is supporting and creating opportunities for eligible lower income single parents, older singles and first home buyers to live in their own home through the Shared Equity Home Buyer Helper scheme.

How does Shared Equity Home Buyer Helper Work?

For eligible persons, the NSW Government will contribute up to 40% of the purchase price for new dwellings, and 30% of the purchase price of established properties, in exchange for an equivalent interest in the property. The Government will secure its interest in the property by way of a registered second mortgage, meaning a smaller deposit and lower monthly repayments for the purchaser.

All purchase costs, including stamp duty, are the responsibility of the participant. Participants will also remain eligible for first home buyer programs and any stamp duty or land tax concessions where applicable.

Do participants pay rent to the government?

No payments, such as rent or interest, are required to the Government as part of this scheme whilst the participant remains eligible for the initiative. Participants can make voluntary payments to increase their share in the property.

How do participants remain eligible for this scheme?

To remain eligible, participants will need to occupy the property as a principal place of residence and meet ongoing requirements, including property maintenance, property insurance and periodic reviews. Participants are also responsible for ongoing property costs such as council rates, body corporate fees and utilities.

What happens if the property is sold?

When the property is sold, the NSW Government will share in the gains or losses with the participant from the sale.

Who is eligible for this initiative?

The Shared Equity Home Buyer Helper scheme is currently open to:

- A single parent of a dependent child or children

- A single person aged 50 or above

- First home buyer key workers who are nurses, midwives, paramedics, teachers, early childhood educators and police officers

To be eligible for this scheme, you must also:

- Have a gross household income of no more than $93,200 for singles and $124,200 for couples

- Buy a home with a property price no more than $950,000 in Sydney and major regional centres (Newcastle, Illawarra, Central Coast, Lake Macquarie, North Coast of NSW) or no more than $600,000 in other regional areas.

- Be at least 18 and an Australian or New Zealand citizen, or a permanent Australian resident

- Have a minimum deposit of 2% of the purchase price

- Live in the property as your principal place of residence

As a single parent or older single applicant, you must not own an interest in any other land or property at the time of settlement on your newly purchased house.

As a first home buyer key worker, you and your spouse/partner must not have previously owned an interest in any land or property in Australia.

Victorian Homebuyer Fund

What is the Victorian Homebuyer Fund?

The Victorian Homebuyer Fund (VHF) is an initiative by the Victorian Government to support eligible homebuyers in purchasing a property by contributing up to 25% of the purchase price in exchange for an equivalent share in the property. This scheme aims to help more Victorians achieve homeownership by reducing the financial barriers to entering the property market.

How does the Victorian Homebuyer Fund work?

For eligible participants, the Victorian Government will provide up to 25% of the purchase price for new or existing properties, allowing homebuyers to reduce their loan amount and monthly mortgage repayments. The Government’s share in the property is secured through a registered second mortgage.

Do participants pay rent to the government?

No, participants are not required to pay rent or interest to the Government while they remain eligible for the initiative. However, participants have the option to make voluntary payments to increase their equity in the property.

How do participants remain eligible for this scheme?

Participants must use the property as their principal place of residence and adhere to ongoing requirements, such as maintaining the property, keeping property insurance, and undergoing periodic reviews. They are also responsible for ongoing costs like council rates, body corporate fees, and utilities.

What happens if the property is sold?

When the property is sold, the Victorian Government will share in the gains or losses from the sale with the participant, based on the Government’s equity share in the property.

Who is eligible for this initiative?

The Victorian Homebuyer Fund is open to:

- Australian citizens or permanent residents who are at least 18 years old.

- Applicants with a gross household income of no more than $125,000 for singles or $200,000 for couples. Additional eligibility criteria include:

A minimum deposit of 5% of the property purchase price.

- The property must be valued at $950,000 or less in metropolitan Melbourne and Geelong, or $600,000 or less in regional Victoria.

- Participants must not currently own an interest in any property in Australia.

Benefits of the Victorian Homebuyer Fund:

- Reduced loan amount and monthly mortgage repayments.

- Lower deposit requirement, making homeownership more accessible.

- The option to make voluntary payments to increase equity in the property.

- Eligibility for first home buyer programs and applicable concessions.

Queensland: Pathways Shared Equity Loan

What is the Pathways Shared Equity Loan?

The Pathways Shared Equity Loan is a program initiated by the Queensland Government to support eligible homebuyers by contributing a portion of the property purchase price in exchange for an equivalent share in the property. This scheme aims to make homeownership more accessible by reducing the financial burden of buying a home.

How does the Pathways Shared Equity Loan work?

Under the Pathways Shared Equity Loan, the Queensland Government will contribute up to 35% of the purchase price for eligible new or existing properties. This reduces the amount the homebuyer needs to borrow, leading to lower monthly mortgage repayments. The Government’s share in the property is secured by a registered second mortgage.

Do participants pay rent to the government?

No, participants are not required to pay rent or interest to the Government while they remain eligible for the scheme. However, participants have the option to make voluntary payments to increase their ownership share in the property.

How do participants remain eligible for this scheme?

Participants must occupy the property as their principal place of residence and meet ongoing requirements, including property maintenance, property insurance, and periodic reviews. Participants are also responsible for ongoing property costs such as council rates, body corporate fees, and utilities.

What happens if the property is sold?

When the property is sold, the Queensland Government will share in the gains or losses from the sale with the participant, based on the Government’s equity share in the property.

Who is eligible for this initiative?

The Pathways Shared Equity Loan is open to:

- Queensland residents who are at least 18 years old.

- Applicants with a gross household income of no more than $100,000 for singles or $150,000 for couples.

Additional eligibility criteria include:

- A minimum deposit of 2% of the property purchase price.

- The property must be valued at $600,000 or less in metropolitan areas, or $400,000 or less in regional areas.

- Participants must not currently own an interest in any property in Australia.

Benefits of the Pathways Shared Equity Loan:

- Lower loan amount and reduced monthly mortgage repayments.

- Reduced deposit requirement, making homeownership more achievable.

- The option to make voluntary payments to increase ownership share.

- Eligibility for first home buyer programs and applicable concessions.

The Pathways Shared Equity Loan offers a practical and supportive pathway to homeownership, helping Queensland residents achieve their dream of owning a home with reduced financial stress.

ACT: Shared Equity Scheme

What is the ACT Shared Equity Scheme?

The ACT Shared Equity Scheme is an initiative by the Australian Capital Territory (ACT) Government designed to assist eligible homebuyers in purchasing their own home by sharing the cost. This scheme aims to make homeownership more accessible and affordable for individuals and families who may not have the financial means to buy a home on their own.

How does the ACT Shared Equity Scheme work?

Under this scheme, the ACT Government will co-own the property with the homebuyer, contributing a percentage of the purchase price. This reduces the loan amount required by the homebuyer, resulting in lower monthly mortgage repayments. The government’s share in the property is secured by a registered second mortgage.

Do participants pay rent to the government?

No, participants do not pay rent or interest on the government’s share of the property. However, they have the option to make voluntary payments to increase their ownership share over time.

How do participants remain eligible for this scheme?

Participants must:

- Occupy the property as their principal place of residence.

- Maintain the property and keep it insured.

- Cover all ongoing property costs, including council rates, utilities, and any body corporate fees.

What happens if the property is sold?

When the property is sold, the ACT Government will share in the gains or losses from the sale, proportional to their share in the property.

Who is eligible for this initiative?

The ACT Shared Equity Scheme is open to:

- ACT residents who are at least 18 years old.

- Individuals and families with gross household incomes within specified limits.

- Applicants who have a minimum deposit of at least 2% of the purchase price.

Additional eligibility criteria include:

- The property must be within the price limits set by the scheme.

- Applicants must not own any other property at the time of purchase.

Benefits of the ACT Shared Equity Scheme:

- Reduced loan amount and lower monthly mortgage repayments.

- Lower deposit requirement, making it easier to enter the property market.

- The option to gradually increase ownership share by making voluntary payments.

- Eligibility for first home buyer grants and applicable concessions.

The ACT Shared Equity Scheme offers a valuable opportunity for aspiring homeowners in the ACT, providing financial support and a clear pathway to achieving homeownership.

South Australia: HomeStart Finance Shared Equity Option

What is the HomeStart Finance Shared Equity Option?

The HomeStart Finance Shared Equity Option is a program by the South Australian Government designed to help eligible homebuyers by contributing a portion of the property purchase price in exchange for an equivalent share in the property. This initiative aims to make homeownership more accessible by reducing the financial burden on homebuyers.

How does the HomeStart Finance Shared Equity Option work?

Under this scheme, HomeStart Finance will contribute up to 25% of the purchase price for eligible new or established properties. This reduces the amount the homebuyer needs to borrow, leading to lower monthly mortgage repayments. The Government’s share in the property is secured by a registered second mortgage.

Do participants pay rent to the government?

No, participants are not required to pay rent or interest to the Government while they remain eligible for the scheme. However, participants can make voluntary payments to increase their ownership share in the property over time.

How do participants remain eligible for this scheme?

Participants must occupy the property as their principal place of residence and meet ongoing requirements, including property maintenance, property insurance, and periodic reviews. Participants are also responsible for ongoing property costs such as council rates, body corporate fees, and utilities.

What happens if the property is sold?

When the property is sold, HomeStart Finance will share in the gains or losses from the sale with the participant, based on the Government’s equity share in the property.

Who is eligible for this initiative?

The HomeStart Finance Shared Equity Option is open to:

- South Australian residents who are at least 18 years old.

- Applicants with a gross household income within specified limits, which may vary depending on individual circumstances.

Additional eligibility criteria include:

- A minimum deposit requirement, which may be as low as 3% of the property purchase price.

- The property must be within the specified price limits set by HomeStart Finance.

- Participants must not currently own an interest in any property in Australia.

Benefits of the HomeStart Finance Shared Equity Option:

- Reduced loan amount and lower monthly mortgage repayments.

- Lower deposit requirement, making homeownership more attainable.

- The option to make voluntary payments to increase ownership share.

- Eligibility for first home buyer programs and applicable concessions.

The HomeStart Finance Shared Equity Option offers a supportive pathway to homeownership, helping South Australian residents achieve their dream of owning a home with reduced financial stress.

Western Australia: Shared Home Ownership

What is the Shared Home Ownership Scheme?

The Shared Home Ownership Scheme, facilitated by Keystart and the Western Australian Government, aims to help eligible homebuyers purchase a property by sharing the cost of the home. This initiative makes homeownership more affordable and accessible, especially for those who may struggle to meet the full purchase price on their own.

How does the Shared Home Ownership Scheme work?

Under this scheme, Keystart will co-own the property with the homebuyer, contributing up to 30% of the purchase price. This significantly reduces the loan amount needed by the homebuyer, resulting in lower monthly mortgage repayments. The government’s share in the property is secured by a registered second mortgage.

Do participants pay rent to the government?

No, participants do not pay rent or interest on the government’s share of the property. However, they have the option to make voluntary payments to buy out a larger share of the property over time.

How do participants remain eligible for this scheme?

Participants must:

- Occupy the property as their principal place of residence.

- Maintain the property and keep it insured.

- Cover all ongoing property costs, including council rates, utilities, and any body corporate fees.

What happens if the property is sold?

When the property is sold, the Western Australian Government will share in the gains or losses from the sale, proportional to their share in the property.

Who is eligible for this initiative?

The Shared Home Ownership Scheme is open to:

- Western Australian residents who are at least 18 years old.

- Individuals and families with gross household incomes within specified limits.

- Applicants who have a minimum deposit of at least 2% of the purchase price.

Additional eligibility criteria include:

- The property must be within the price limits set by Keystart.

- Applicants must not own any other property at the time of purchase.

Benefits of the Shared Home Ownership Scheme:

- Reduced loan amount and lower monthly mortgage repayments.

- Lower deposit requirement, making it easier to enter the property market.

- The option to gradually increase ownership share by making voluntary payments.

- Eligibility for first home buyer grants and applicable concessions.

The Shared Home Ownership Scheme offers a practical solution for Western Australians aspiring to own a home, providing financial support and a pathway to achieving homeownership.

Tasmania: MyHome Shared Equity Scheme

What is the MyHome Shared Equity Scheme?

The MyHome Shared Equity Scheme is an initiative by the Tasmanian Government aimed at helping eligible homebuyers achieve homeownership by sharing the cost of purchasing a property. This program makes buying a home more affordable and accessible for those who may struggle to secure the full purchase price on their own.

How does the MyHome Shared Equity Scheme work?

Under this scheme, the Director of Housing will co-own the property with the homebuyer, contributing up to 30% of the purchase price. This significantly reduces the loan amount needed by the homebuyer, resulting in lower monthly mortgage repayments. The government’s share in the property is secured by a registered second mortgage.

Do participants pay rent to the government?

No, participants do not pay rent or interest on the government’s share of the property. However, they have the option to make voluntary payments to increase their ownership share over time.

How do participants remain eligible for this scheme?

Participants must:

- Occupy the property as their principal place of residence.

- Maintain the property and keep it insured.

- Cover all ongoing property costs, including council rates, utilities, and any body corporate fees.

What happens if the property is sold?

When the property is sold, the Tasmanian Government will share in the gains or losses from the sale, proportional to their share in the property.

Who is eligible for this initiative?

The MyHome Shared Equity Scheme is open to:

- Tasmanian residents who are at least 18 years old.

- Individuals and families with gross household incomes within specified limits.

- Applicants who have a minimum deposit of at least 2% of the purchase price.

Additional eligibility criteria include:

- The property must be within the price limits set by the scheme.

- Applicants must not own any other property at the time of purchase.

Benefits of the MyHome Shared Equity Scheme:

- Reduced loan amount and lower monthly mortgage repayments.

- Lower deposit requirement, making it easier to enter the property market.

- The option to gradually increase ownership share by making voluntary payments.

- Eligibility for first home buyer grants and applicable concessions.

The MyHome Shared Equity Scheme offers a practical solution for Tasmanians aspiring to own a home, providing financial support and a pathway to achieving homeownership.